Ascensus

Fintech

UX Designer & Researcher

Professional Work

Creating seamless onboarding to expand retirement plan access

Redesgining the enrollment experience to support clarity, accessibility, and scale across a complex retirement platform. These improvements helped double asset growth and reduce operational costs by $1M per year.

Closing the retirement savings gap

Equity begins with access, yet for millions of small business employees, especially low-wage and part-time workers, saving for retirement remains out of reach due to limited access to employer-sponsored plans.

State-Facilitated Retirement Savings Programs (SFRPs) were created to close this gap, and Ascensus plays a central role in administering these programs nationwide. As adoption scaled, the existing employer onboarding experience struggled to support growing demand. Complex flows, limited self-service, and high support dependency created friction for employers and operational strain for internal teams.

As the designer leading this initiative, I partnered closely with product, engineering, and operations to redesign the employer registration and onboarding experience from the ground up. The challenge was to balance regulatory complexity with clarity, accessibility, and scalability — while supporting a surge of more than 250,000 employers onboarding within a fixed deadline.

The resulting experience focused on reducing cognitive load, enabling self-service, and designing flexible systems that could scale across states and programs. These improvements contributed to doubling asset growth and reducing operational costs by $1M annually, while expanding access to retirement savings for millions of workers.

Digital strategy consulting | Leveraging research to reduce call volume

To understand pain points in Ascensus' existing digital touchpoints, our team dove into qualitative research, including:

Facilitating our Outcomes Workshops with Ascensus stakeholders to align on North Star outcomes

Interviewing Ascensus call center representatives to identify common issues customers faced during registration and onboarding

Conducting user interviews with a diverse cross-section of employers and HR/payroll professionals to unpack their challenges

Through these exercises, we identified key pain points aligned with possible call reduction strategies:

Employer registration flow generated high call volume, indicating a need to simplify

Language around pay cycles was confusing for employers

Employers wanted more intuitive self service options to reduce the need for phone calls

The strategy was clear: A streamlined registration process would boost employer enrollment, minimize inbound calls and optimize the overall user experience.

“ Employers’ early experiences with the program are essential to its success. We needed expertise and capability because we wanted to be sure that every employer from large corporations to small mom-and-pop shops, would have the most supportive and seamless experience possible.”

George Piquette

Head of SFRP (Retirment), Ascensus

Brand and experience design | Empowering employers with simplified user experience

Equity begins with access, yet for millions of small business employees, especially low-wage and part-time workers, saving for retirement remains out of reach due to limited access to employer-sponsored plans.

State-Facilitated Retirement Savings Programs (SFRPs) were created to close this gap, and Ascensus plays a central role in administering these programs nationwide. As adoption scaled, the existing employer onboarding experience struggled to support growing demand. Complex flows, limited self-service, and high support dependency created friction for employers and operational strain for internal teams.

As the designer leading this initiative, I partnered closely with product, engineering, and operations to redesign the employer registration and onboarding experience from the ground up. The challenge was to balance regulatory complexity with clarity, accessibility, and scalability — while supporting a surge of more than 250,000 employers onboarding within a fixed deadline.

The resulting experience focused on reducing cognitive load, enabling self-service, and designing flexible systems that could scale across states and programs. These improvements contributed to doubling asset growth and reducing operational costs by $1M annually, while expanding access to retirement savings for millions of workers.

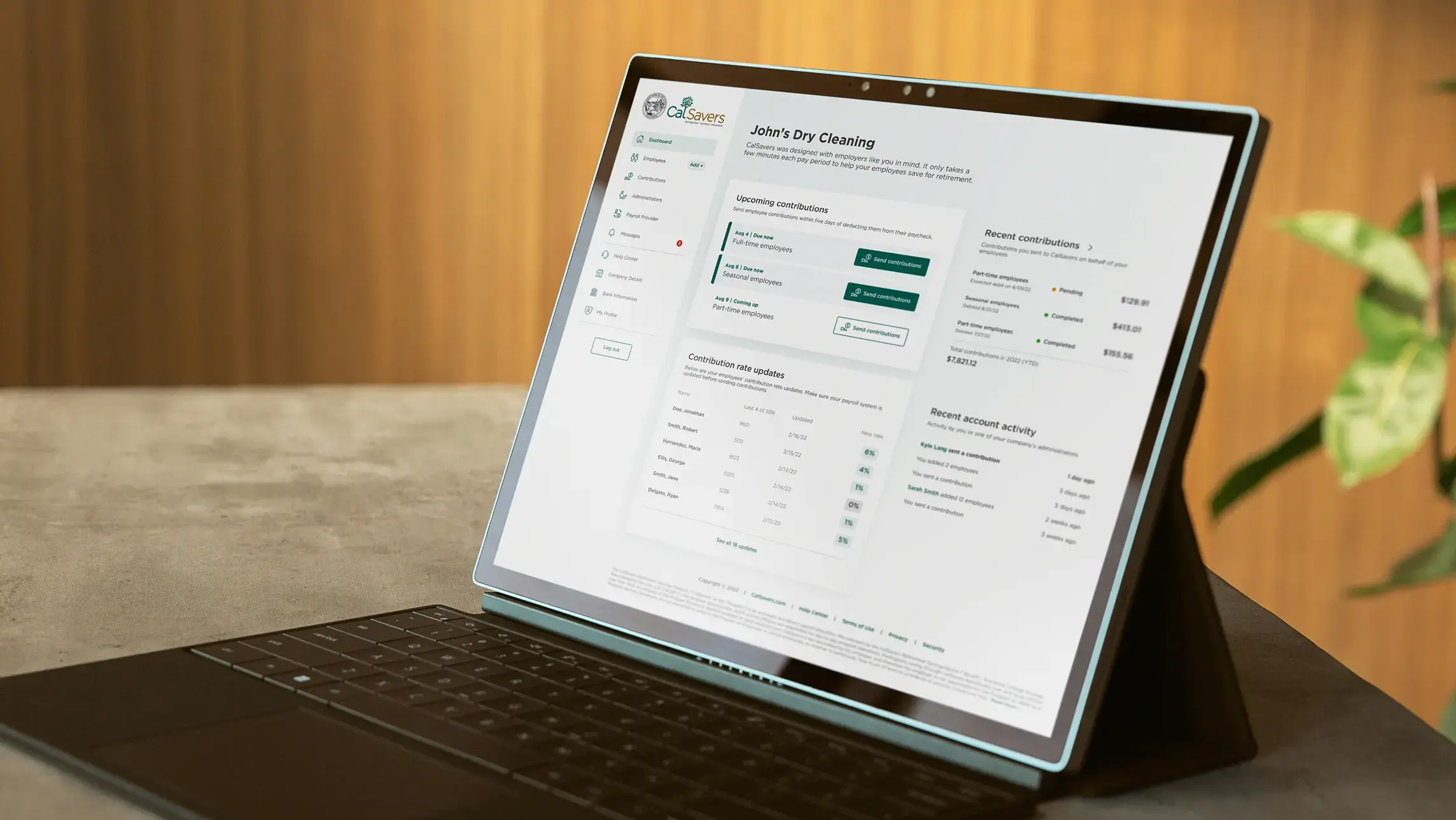

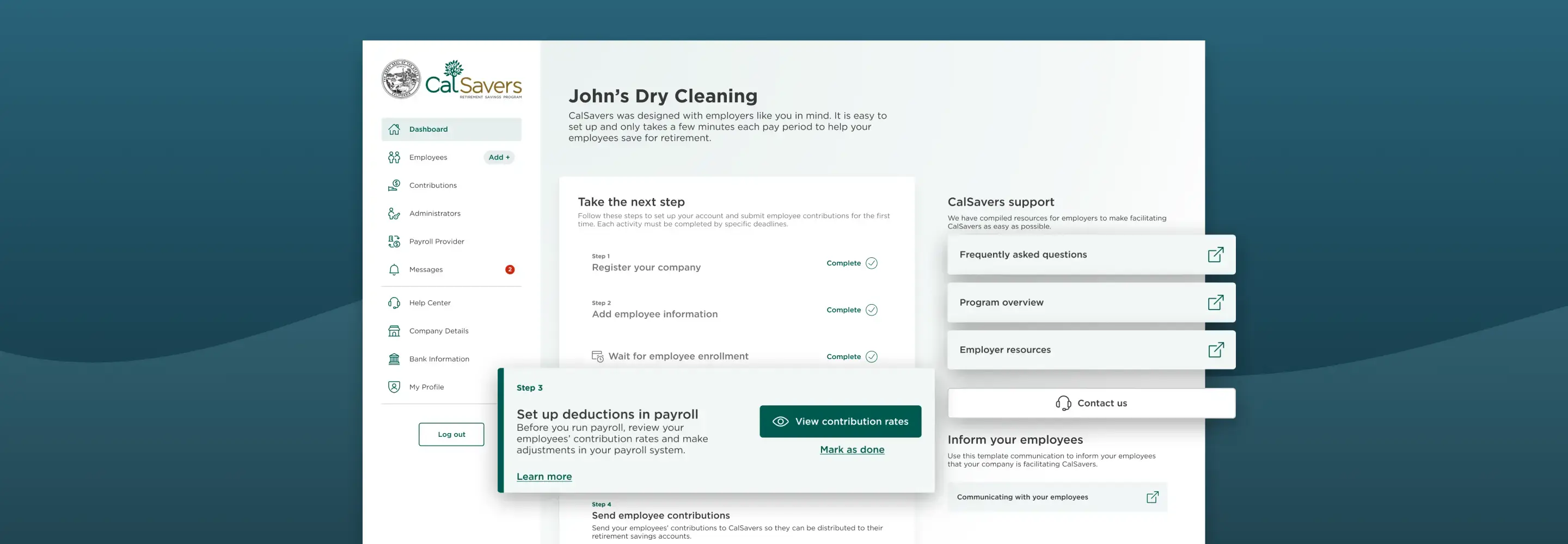

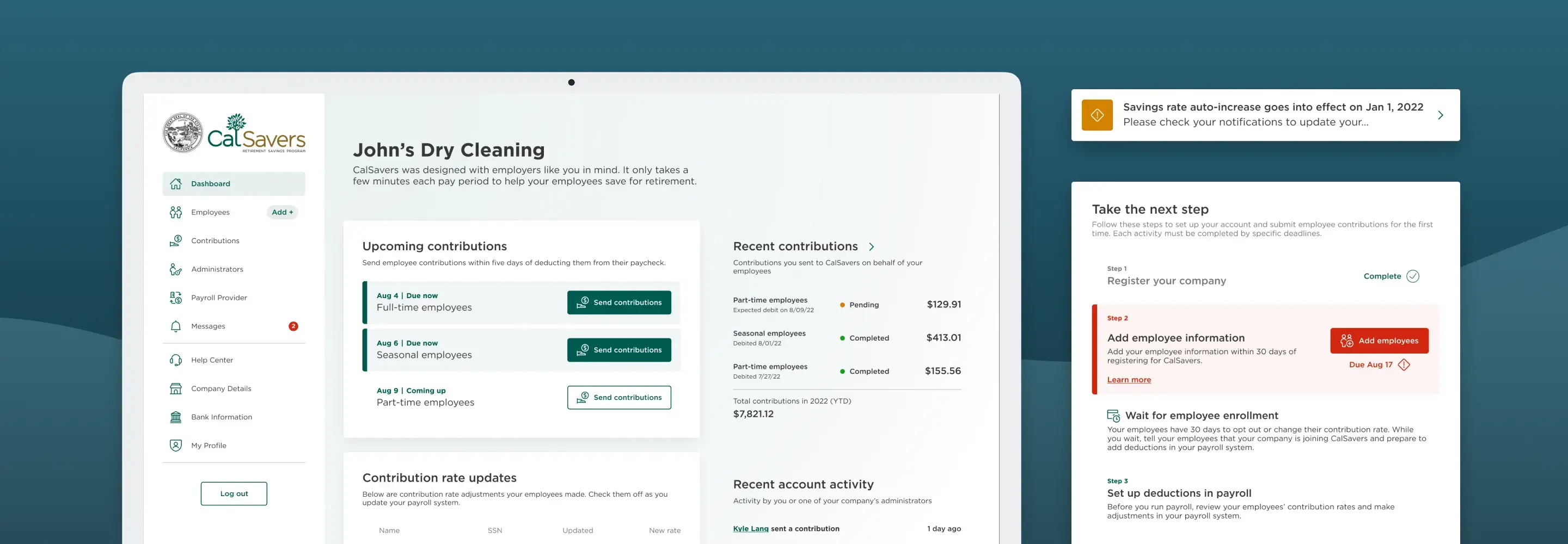

Product development | Building an intuitive web platform

With a design vision in place, our team created development-ready assets for Ascensus’ web platform. Further user feedback and A/B testing ensured that all user challenges were addressed before launch.

Our initial approach focused on California, but our vision quickly shifted to Illinois and other states at the forefront of the SFRP movement. The goal was to equip Ascensus with a consistent set of tools that are seamless to customize and update as dozens of new states inevitably come into the fold and adopt SFRPs.

New digital experiences rolled out, featuring:

A new, user-friendly employer dashboard

Simplified employer registration flow

Clear tooltips and help messaging for self-service

These steps culminated in a digital transformation that offered employers easy and efficient ways to enroll their employees while optimizing customer support. Greatly increasing adoption rates will exponentially impact employees who previously lacked access to crucial savings plans.

Results | Revolutionizing retirement services

Ascensus and their state partners have now doubled their combined assets under administration since the start of 2023 — surpassing $1 billion — due to an influx of newly registered employers.

“While the $1 billion mark is an exciting threshold, what’s even more encouraging is that this represents nearly 650,000 savers — many who are saving for retirement for the first time,” said Peg Creonte, president of Ascensus Government Savings.

The newly built employer portal has played a key role in this increase in successful registrations, as well as a noteworthy reduction in the time required to complete key enrollment steps, vastly improving the registration process across major metrics:

New user-friendly platforms signified a monumental shift for Ascensus, placing greater financial power into the hands of workers previously devoid of such access.

The digital products, while focused on individual user experience and customer support, collectively pave the way for Ascensus to revolutionize the retirement savings landscape.

As Ascensus continues its journey to provide cutting-edge digital experiences to its users, we’re proud to be its trusted partner in creating an empowering ecosystem for retirement savings. Together, we’re elevating user experiences and making retirement planning more accessible for all.

New user-friendly platforms signified a monumental shift for Ascensus, placing greater financial power into the hands of workers previously devoid of such access.

The digital products, while focused on individual user experience and customer support, collectively pave the way for Ascensus to revolutionize the retirement savings landscape.

As Ascensus continues its journey to provide cutting-edge digital experiences to its users, we’re proud to be its trusted partner in creating an empowering ecosystem for retirement savings. Together, we’re elevating user experiences and making retirement planning more accessible for all.

100%

increase in combined assets under management, representing 650,000 savers

24%

uptick in SFRP employer enrollment

600%

surge in employers completing same-day enrollment

$1M

annual reduction in operating costs attributed to decreased call center volume

New user-friendly platforms signified a monumental shift for Ascensus, placing greater financial power into the hands of workers previously devoid of such access.

The digital products, while focused on individual user experience and customer support, collectively pave the way for Ascensus to revolutionize the retirement savings landscape.

As Ascensus continues its journey to provide cutting-edge digital experiences to its users, we’re proud to be its trusted partner in creating an empowering ecosystem for retirement savings. Together, we’re elevating user experiences and making retirement planning more accessible for all.